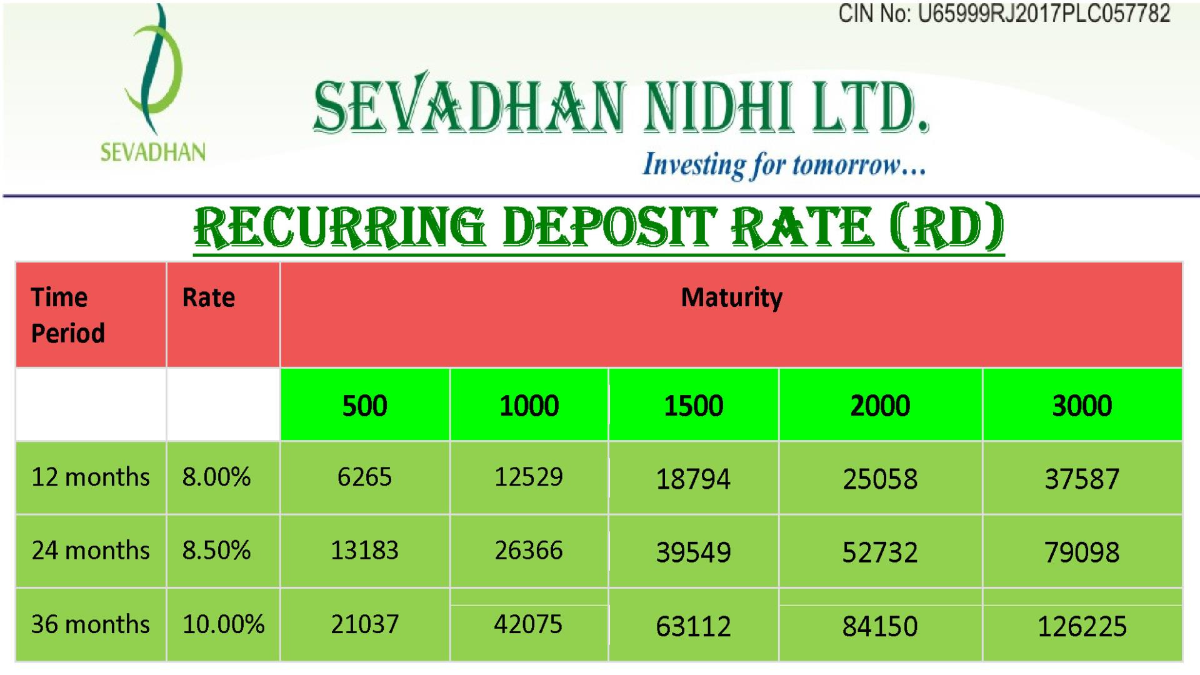

Recurring Deposit Rate (RD)

Tenure of Payment

The tenure of the account is 12 months (minimum) and above.

Mode of Payment

AIl payments to the Nidhi shall be made either in Cash/ Cheque/ Neft/ Rtgs/ Electronic wallet against the receipt countersigned by its authorized signatory, payments by any other mode mentioned above shall be at the member account holder's own risk. The cheque/ Cheque/ Neft/ Rtgs/ Electronic wallet shall be credited in the name of member Account Holder subject to clearance by the bank of SDNL. Out station cheques shall not be accepted/ will be accounted after the credit of the cheque.

lssue of Passbook

A passbook will be issued to every Member Account Holder by SDNL. The Member Account Holder shall get the pass book updated at regular intervals. If any discrepancy or difference in the amount is found between the entries made in the passbook and receipts duly countersigned by the authorized signatory of the branch office bearing seal. Payment shall be made on the basis of receipts only.

Terms & Conditions:

- It is mandatory to be a member = share holder with 10 shares (10/- Rs each).

- Interest will be calculated on yearly basis.

- Recurring Deposit minimum amount Rs 500/-, and can be in multiples of Rs 100/.

- Loan on deposits will be charged at 18% yearly compound interest basis.

- 1 month after paying last installment or maturity amount due date whichever is more will be applicable for payment of maturity amount.

- Irregular deposits are not entitled for pre mature payment and loan facility against it.

- On irregular deposits if all irregular pending deposits are paid then such account will be treated as regular. Even if there is default in payment of 1 installment, the said account will be treated as irregular.

- After maturity date, payment on irregular accounts will be made after deducting the penalty amount maximum to the limit of interest earned on such account. No deductions will be made on principle amount of such accounts.

- R.D. will not be premature within 6 month.( if only the premium of 6 months is paid, no interest will be given)

- If R.D. is matured after 6 month but before 9 month no interest will be paid.

- If any person premature its R.D then the person will be paid 1% , less of maturity interest after 6 months.

in case of death of a depositor, the company will repay to nominee or beneficiary the principal & interest, at which it was accepted.